Fascination About Mileagewise - Reconstructing Mileage Logs

Fascination About Mileagewise - Reconstructing Mileage Logs

Blog Article

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Main Principles Of Mileagewise - Reconstructing Mileage Logs Fascination About Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs Excitement About Mileagewise - Reconstructing Mileage Logs10 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownSome Of Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Timeero's Quickest Distance feature suggests the fastest driving path to your staff members' destination. This function improves efficiency and adds to set you back financial savings, making it a necessary asset for companies with a mobile labor force. Timeero's Suggested Course attribute additionally increases liability and efficiency. Staff members can compare the suggested path with the actual path taken.Such an approach to reporting and conformity streamlines the usually complicated job of handling gas mileage expenditures. There are many advantages connected with making use of Timeero to monitor mileage. Let's have a look at some of the application's most significant functions. With a trusted mileage monitoring device, like Timeero there is no requirement to fret about unintentionally omitting a date or item of info on timesheets when tax obligation time comes.

Everything about Mileagewise - Reconstructing Mileage Logs

With these devices in use, there will certainly be no under-the-radar detours to raise your repayment costs. Timestamps can be discovered on each gas mileage entry, enhancing credibility. These additional verification steps will keep the IRS from having a factor to object your gas mileage records. With precise gas mileage monitoring modern technology, your workers don't need to make rough mileage estimates or even fret about gas mileage expenditure monitoring.

As an example, if a worker drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all vehicle expenses. You will certainly require to continue tracking gas mileage for job also if you're utilizing the real cost approach. Keeping mileage records is the only way to different company and personal miles and provide the evidence to the IRS

Many gas mileage trackers allow you log your trips manually while determining the range and compensation quantities for you. Numerous likewise come with real-time trip monitoring - you require to begin the application at the begin of your trip and stop it when you reach your final destination. These apps log your begin and end addresses, and time stamps, in addition to the total range and reimbursement quantity.

Everything about Mileagewise - Reconstructing Mileage Logs

Among the concerns that The INTERNAL REVENUE SERVICE states that vehicle expenditures can be taken into consideration as an "ordinary and essential" price throughout working. This consists of costs such as fuel, maintenance, insurance, and the lorry's depreciation. Nevertheless, for these prices to be taken into consideration insurance deductible, the lorry needs to be made use of for organization purposes.

What Does Mileagewise - Reconstructing Mileage Logs Do?

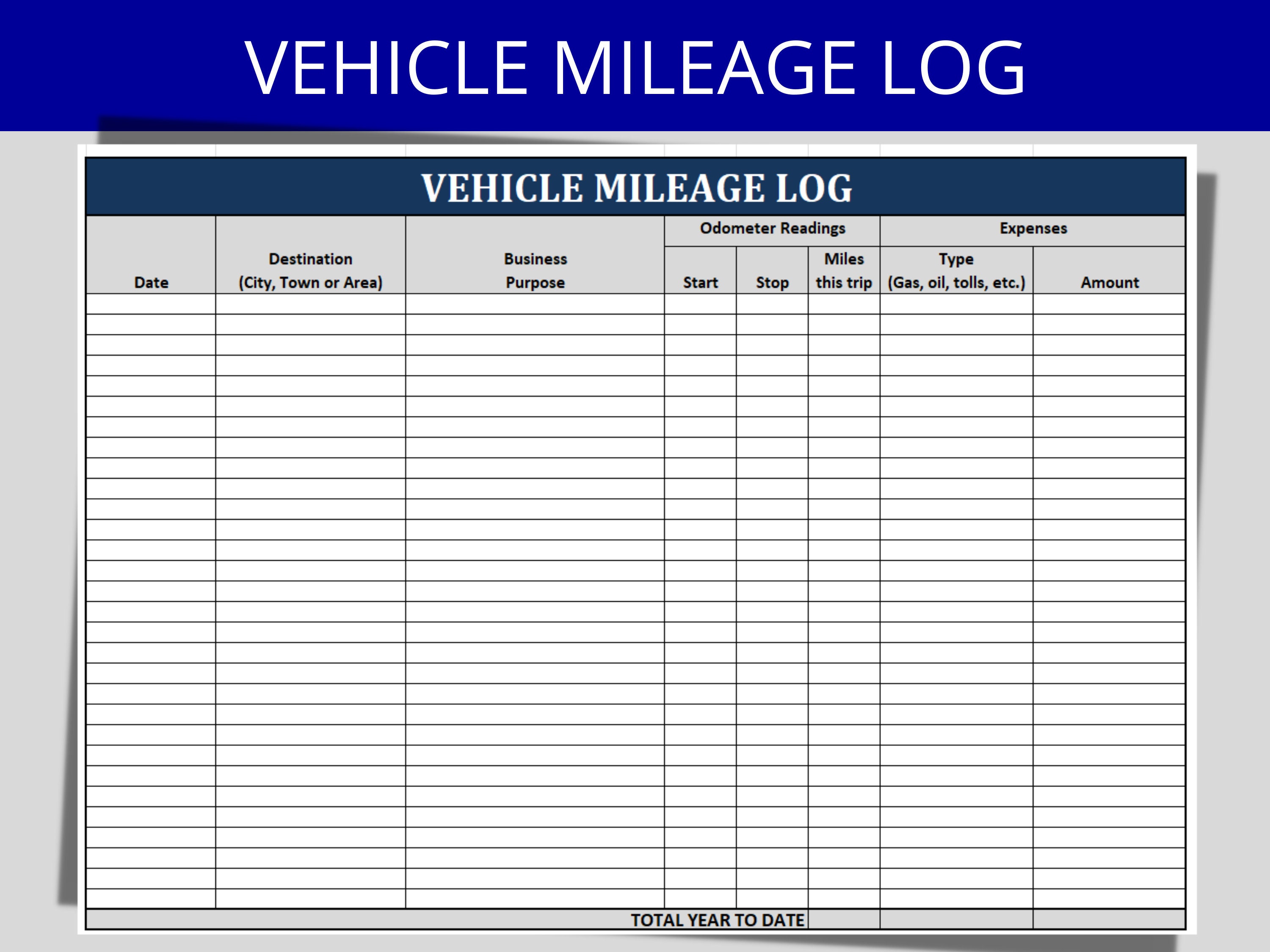

In in between, faithfully track all your organization journeys noting down the beginning and ending readings. For each journey, record the area and business objective.

This includes the complete organization mileage and overall mileage buildup for the year (service + individual), journey's day, destination, and objective. It's vital to tape-record tasks quickly and maintain a synchronous driving log detailing day, miles driven, and business objective. Below's exactly how you can boost record-keeping for audit purposes: Start with making sure a careful gas mileage log for all business-related travel.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

The actual expenses method is an alternate to the typical mileage rate method. Rather than determining your deduction based upon a predetermined price per mile, the real costs method permits you to subtract the actual prices related to utilizing your lorry for company purposes - mileage tracker app. These expenses include fuel, maintenance, repair services, insurance coverage, depreciation, and other associated expenditures

Those with significant vehicle-related expenditures or one-of-a-kind conditions might profit from the real costs technique. Inevitably, your chosen approach should align with your specific economic objectives and tax scenario.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

(https://mileagewise-reconstructing-mileage-logs.webflow.io/)Compute your overall business miles by utilizing your start and end odometer readings, and your taped company miles. Accurately tracking your exact mileage for organization trips help in corroborating your tax helpful site obligation deduction, specifically if you opt for the Requirement Gas mileage technique.

Keeping track of your mileage by hand can require persistance, but keep in mind, it might save you cash on your taxes. Videotape the total mileage driven.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

And currently almost every person uses General practitioners to get around. That suggests virtually everyone can be tracked as they go regarding their service.

Report this page